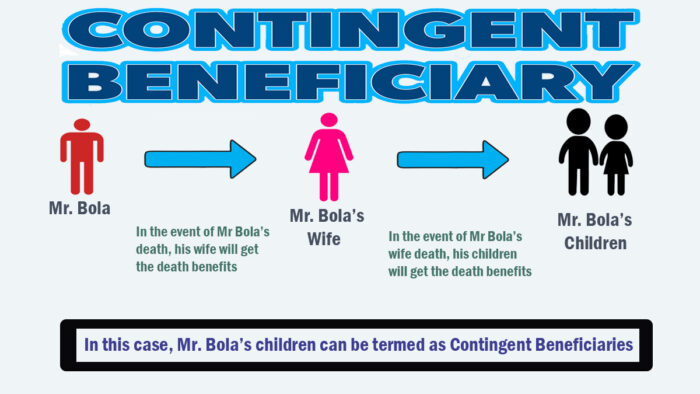

A contingent beneficiary, also known as the secondary beneficiary, is an individual or entity who inherits the policyholder’s assets in the event that the primary beneficiary is unable to claim the proceeds or payout.

The primary beneficiary is the actual beneficiary of the policy, while a contingent beneficiary serves as a backup recipient for the policyholder.

This feature in the life insurance policy is essentially designed to provide a backup that offers protection and ensure that the wish of the primary beneficiary is carried out in the event of an unforeseen situation like death.

In the process of applying for a life insurance policy, your insurance company will request that you designate a primary beneficiary on your policy; it could be one or more.

Do I Need A Contingent Beneficiary?

Although it is not mandatory to name a contingent beneficiary in your life insurance policy, we still think it is a good idea.

This would help to ensure that your assets are left in the hands of people who matter to you. This includes your spouse, children, relatives, or friends.

In the event of the primary beneficiary passing on, the death benefit will be transferred to the secondary beneficiary named on the policy.

What Happens If There Is No Named Contingent Beneficiary?

Well, if no contingent beneficiary is named and the primary beneficiary passes on, the asset and property will automatically be deemed part of the estate and will require probate.

This is one of the reasons why we advise policyholders to name at least one secondary beneficiary to their policy. But if you have a will that designates people to the property and assets, then it would be distributed to them.

How Many Contingent Beneficiaries Am I Allowed to Name On My Policy?

The number of contingent beneficiaries you can name on your policy depends on the insurance company you are working with. But usually, you can have more than three contingent beneficiaries.

As long as your insurance company approves the number of contingent beneficiaries you want to name on the policy, then you are good to go.

Can I Add My Child As A Contingent Beneficiary?

Yes, it is possible to add your child as a contingent beneficiary, provided there’s a guardian in the picture to assist the child in managing the asset and property. A child can be named as the secondary beneficiary if you want your assets to be supervised by a blood line.

Here’s our advice: if you are naming your child as a contingent beneficiary, it makes more sense to extend the management of the asset to a later age where your child will be more than capable of preside over your property. It can be when your child reaches 18 years of age or when he/she graduates from college.

How to Choose Contingent Beneficiary

Apparently, you can name anyone you want as a contingent beneficiary in your life insurance policy. It could be your business, an origination you’ve worked with, or your close relatives. But before then, ensure you purchase life insurance first and see to it that the policy allows you to change the beneficiaries if there’s a need for it.

When choosing a contingent beneficiary, make sure you are naming a person or entity you trust to manage your property and assets efficiently. This would give you peace of mind knowing that your assets are in good hands.

Irrespective of whether the beneficiary is primary or secondary, make it your point of duty to let them know of their status. By doing that, the secondary beneficiary is aware of his/her responsibility. Then he/she will be able to take the necessary steps to claim the death benefits you have.

You can designate as many contingent beneficiaries as your insurance company allows you to. All you have to do is share your property and assets in a way that involves all the beneficiaries named on your policy.

FAQS

What is the difference between a primary and contingent beneficiary?

The primary beneficiary is the main inheritor of an insurance proceeds and the first to receive the benefits offered by the coverage in the event of any claim.

On the other hand, the contingent beneficiary is the named person that is next in line to receive the policy’s benefit if the primary beneficiary is a victim of an unforeseen circumstance like death. A contingent beneficiary can be the policyholder’s child, sibling, spouse, parents, and other close relatives.

Can I change my secondary beneficiary?

Well, it may be possible to change your contingent beneficiary if the beneficiaries named in your policy can be revoked. For instance, if you are no longer in a close relationship with the person named as a secondary beneficiary on your policy, you can replace them with another person.

For clarity purposes, you should request information from your insurance company on how to change your contingent beneficiary as a result of certain reasons best known to you.

Who can be named as a contingent beneficiary?

Literally, anyone and anything can be named as a contingent beneficiary on a life insurance policy. It could be one of your family members, an estate, a trust, etc. Most insurance companies allow the policyholder to select whomever they want as their secondary beneficiary.