One of the biggest investments you will ever make is buying a home. You will want to furnish It with the latest home interiors to make sure you are comfortable. But the cost of that can be unimaginable at times. That is where a cash-out refinance, assists you to complete your home improvement goals. So you don’t have to rely on your credit cards or a second mortgage.

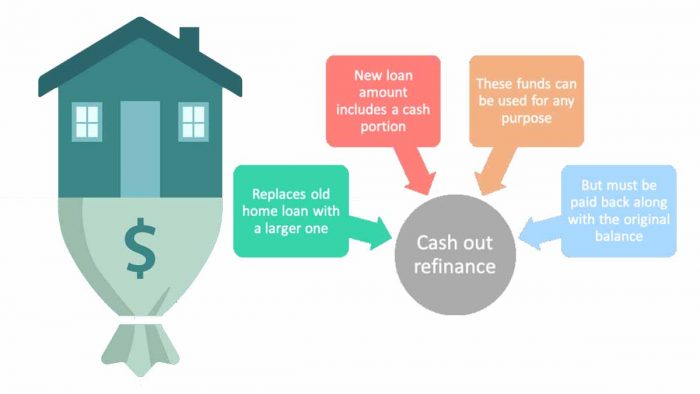

A cash-out refinance replaces your current home loan with a new, bigger loan amount than owned on the previous existing loan. It helps borrowers use their home mortgage to get cash.

With a cash-out refinance you are replacing an existing mortgage with a new one for more than you currently owe on your house. It takes advantage of the equity you have built over a period of time and gives you cash in exchange for taking on a larger mortgage. You can use that money to make repairs on your home and cover an unexpected bill. Furthermore, you pay a lower interest rate than credit cards.

How does Cash Refinance work?

Before you apply for a cash-out refinance you need to meet the requirement. Choose a lender and submit your application to underwriting and wait to check your approval. Below are a few stages to know how refinancing works:

Your lenders set certain requirement when it comes to deciding who qualify for a refinance. You must pose a credit score of at least 620 if you are looking to take your cash out. your DTI income ratio must be less than 50%, this is the number of your monthly debts and payments divided by your total monthly income. You will need to have a high amount of equity built in your home if you want to secure a cash-out refinance,

Know how much you need: once you meet the requirements, determine how much cash you need. If you are thinking of cashing out for repairs and renovations. It’s a good idea to get a few estimates from contractors to know how much you need.

You can apply through your lender after application you will receive a decision on if your lender approves your refinance. You will need to provide your bank statement. Once you get approval, your lender will guide you through the next steps toward closing.

Pros and Cons of cash-out Refinance

Before considering going through with a cash-out refinance, it is advisable to check the pros and cons of cash-out refinancing

- Lower interest rate: this is one of the reasons most borrowers refinance. If the mortgage rates of your home were high when you originally purchased it. You might end up with a lower interest rate.

- Higher credit score: when you do a cash-out refinance and use the funds to pay off debt, you may boost your credit score by reducing your credit utilization ratio the amount you are borrowing compared to what is available to you.

- Access to more funds: cash-out refinances are helpful with major expenses like home renovation, and paying unexpected bills like medical bills.

- Just one loan: it allows one loan per month.

Some cons of cash-out refinance are:

Closing costs: you will have to pay a closing cost for a cash-out refinance, the closing cost range from 2% to 5% of the loan

Time-consuming: since you are getting a new mortgage and you cant skip through all the hoops of a purchase loan, the process can still take weeks.

You are at greater risk of losing your home. Hence, try as much as possible to take out only the cash you need. Also, ensure you are using it for a beneficial purpose that will improve your finances. Failure to repay leads means you could end up losing it to foreclosure because your home is the collateral for any kind of mortgage.

Whether you want to renovate your home or pay a debt, a cash-out refinance is just the right tool for you.