If you want to acquire a new company or merge two companies together, it’s important to buy a runoff insurance policy to protect it from claims that may be made against it after the merger or acquisition.

Not everyone knows what run-off insurance actually means, so if you are on this page and you want to have a wide understanding of what run-off insurance means, then you are in the right place.

What is Runoff insurance?

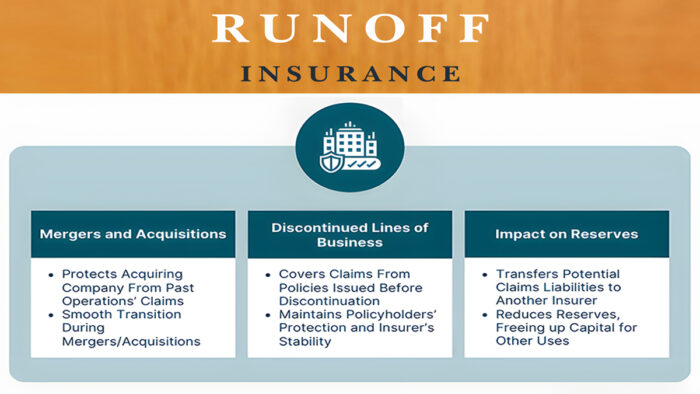

Runoff insurance is also known as “close-out insurance.” It is an insurance policy that protects companies that have been merged with another company from potential claims that might arise against them. Run-off insurance protects a company from legal claims that may be brought against it after it has been merged or has ceased to operate.

Claims could be made after several years of the occurrence of an event, and these claims could cause losses and great damages to your firm or career. The run-off insurance helps to offer coverage for those claims. It helps to protect both the business and its clients from any form of financial loss suffered as a result of negligence performed during the rendering of service to the clients or any third party.

How Does Runoff Insurance Work?

Runoff insurance works by prolonging insurance coverage for entitled claims for a given period of time after the cancellation of a professional insurance policy.

Run-off insurance policies refer to already-concluded contracts for which the reinsurer or insurer still covers your past work, even when a business stops operating. The insurance policy still covers errors and mistakes that may have occurred to the insured before the company emerged or was sold.

Who Needs RunOff Insurance?

Runoff insurance is crucial for anyone who is in the field of providing professional services or consultations. Professionals and consultants like doctors, accountants, contractors, lawyers, insurance professionals, and real estate agents.

If you are a business owner and your business happens to be merged with another business or has been acquired by another, you need run-off insurance. To help protect against any potential legal claims from past errors or omissions.

What Does Runoff insurance Cover?

Here is what run-off insurance covers:

- Run-off insurance offers coverage to firms that have been merged or acquired. Any organization or firm that has merged with another or been acquired should obtain run-off insurance.

- It covers professional liabilities after a business has folded up. Any professional who purchases run-off insurance is literally protecting themselves from potential claims filed by previous clients or a third party.

- It offers retired partners of the firm financial security and does not allow them to be held liable for any claims.

Run-off insurance is an insurance company that covers claims that are made against a law firm after it has stopped doing business.

What Doesn’t Runoff Insurance Cover?

Just like run-off insurance has what it covers, it’s still limited to certain things that it doesn’t cover. Here are the issues it won’t cover:

- Run-off coverage does not provide claims that were not given within the designated happening period of the event. Any issue brought out will not be included in the premium.

- Run-off insurance does not cover claims that the policy doesn’t agree to. Claims include intentional acts of criminal activity or financial theft caused by the insured.

- Any claim known to the policyholder before obtaining the run-off insurance will not be covered. Run-off insurance covers only potential claims that might occur after your services have been rendered.

It is of great importance to understand what run-off insurance covers and what it doesn’t cover before you obtain one.

Why Do I Need Runoff Insurance?

Run-off insurance protects you against past actions or errors made as you metamorphose into a new phase of your profession.

If, for instance, you switch to a different career, like moving from the medical field to a legal firm, runoff insurance covers you from potential claims you have made in your previous profession. Another reason why run-off insurance is needed is when you merge your company with another, or if it’s the reverse case. The merging companies might want to request run-off insurance to safeguard their operations from past claims.

How Long Does Run-off Insurance Take?

Knowing how long a run-off insurance cover takes all depends on your kind of business and you. In knowing how long you need to put into consideration the type of your profession or business and the risk of a claim that is likely to come up when your business or firm ceases operation, if you need run-off insurance, all of these should be put into consideration.

How Much Does It cost?

For run-off insurance, the premium in the first year after closure is the same as the advancing premium in the last year of trading. Run-off insurance costs count even when there is no further coming into the firm; there is still a premium to be paid each year.

The cost of run-off insurance varies from one insurance company to another.

How to Get a Run-Off Insurance Quote

There is really not much competition in the insurance space to provide this coverage. Owners of merged firms or those who switched careers most often purchase insurance for a year after closure. Though some regulations make it mandatory to insure their members, like accountants, etc. The insurance company provides specific years for their members when they cease to practice.

FAQs

How Long Do I Need Runoff Insurance?

How long you need run-off insurance depends on your choice. It requires you to take into consideration your circumstances, past events, type of work, and the likely claims that could arise.

Will Claims be Attended to When They Come in During the Run-Off Period?

A claim that occurs during the run-off period could still be attended to if only there is a professional indemnity cover in place when the claim is first made.

Why Should I Obtain Runoff Insurance for My Firm?

It’s important to obtain run-off insurance for your firm because it is designed to protect you from claims that may arise after you have stopped running your firm.