PayPal is a well-recognized platform for sending and receiving funds for family and friends. It also serves as one of the best means of making an online payment for purchased goods and services. PayPal is a worldwide recognized platform. which allows the company to produces faster, easier business funding with PayPal working capital. This capital is a great fit for many small businesses, the service is a convenience and low-cost way for a merchant to use PayPal to borrow money.

With this service applications are short and easy; repayment is necessary and fees tend to below. Not all small business owners or merchants get access to this service depending on requirements and patience. When I mean patience, some merchant applies for the service with no clear explanation to PayPal on why they need the capital.

The requirement to apply for PayPal Working Capital?

There are certain terms and conditions you need to abide by before you will be eligible for the PayPal working capital. You don’t need sad with the conditions they are what you could get over and get your capital from PayPal. Here are a few requirements of what you need before you can apply for PayPal working capital;

- You will need a PayPal account, business or personal for at least three months. Because PayPal uses these accounts to determine whether or not you are qualified.

- At least a total sum of $20000 or $15000 In PayPal sales in a year with your PayPal account.

- If you have an existing PayPal working capital loan, you will need to pay it off in full before applying for another round of financing.

How to Apply for a Capital?

Applying for PayPal Working Capital is very simple and easy, just after you abide by the terms and conditions appropriately. Here are a few steps on how to apply for the Capital;

- Launch any web browser on your PC or mobile phone

- Go to www.paypal.com/workingcapital/Log on your PayPal account

- PayPal will determine your eligibility and confirm if your Application to get the Capital is ready.

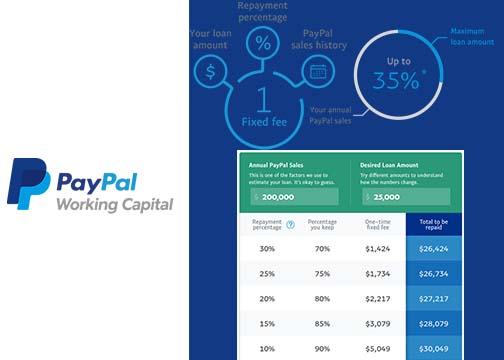

- The next step requires you to select your cash advance amount, and also choose the percentage of sales to repay.

- Go through the terms and conditions and click on agree, immediately your funds will be available.

Approval and funding take only a few minutes since the company already has your information and account history on their file. PayPal working capital gives a flexible payment, one affordable fixed fee, no credit check for every merchant and business owner.