PayPal offers businesses both working capital and traditional term loans to SMBs. Acquiring these loans means you would have to get a business account. PayPal loans are supported by a major institution that is capable of granting you the funding you require. If you cannot meet the requirements of a bank, then PayPal has you covered.

PayPal offers an undisturbed qualification and a reasonable agreement structure. There is no main requirement for getting loans from PayPal, as the company studies your monthly income and makes good use of it as evidence of your financial strength. The main term for a loan by PayPal is that the company goes through your public record before finalizing the approval process.

When it comes to lending, PayPal can’t offer loans to industries including:

- Financial services

- Environmental or wild life organizations

- Independent writers or performers

- Attorneys

- Religious organizations and more.

Aside all these, PayPal don’t always hesitate to provide loans for other minor business owners, who do not want to get their loans from the bank.

PayPal Loans Rates and Terms

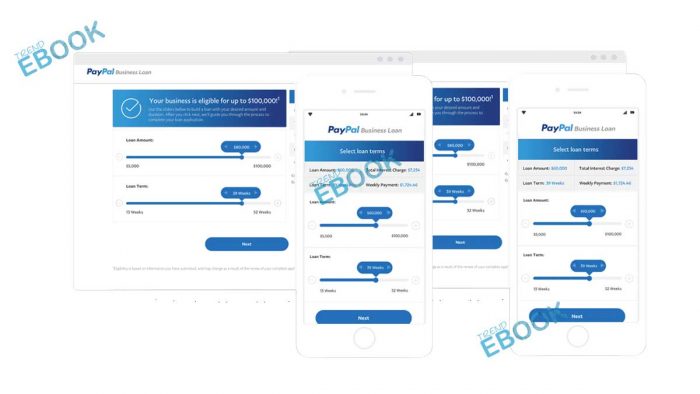

For term loans, businesses can apply for loans beginning from $5,000 to $500,000 with terms stretching from 13 to 52 weeks. If you are to compare this to other source or lenders, this is a short-term loan option. PayPal publicizes on its site that this kind of loan is offers businesses with quick cash with a lower conditions and necessities than other big banks. PayPal Syncs directly with your bank account, and automatically, they deduct weekly payments till the loan term is whole. No other additional fee is required, it is required that you pay $20 returned-item charge that is only accessed if a payment is returned. The loan payment can be completed at any time, but you must pay the interest and full principal interest at the period of payment.

The advance amount you are likely to receive depends on the volume of your sales, and it varies based on your sales during the previous 12 months (previous 1 year of sales). The Payback schedule will vary based on your daily PayPal sales.

PayPal Loans Qualification and Process

When it comes to loaning from PayPal, there are several qualifications, and they depend on the type of loan you are applying for. First:

- Your business must have been running for more than 9 months and generate at least the sum of $42,000 in revenue each year

- Not have any form of bankruptcies.

- Your business also needs to be located in the U.S.

- Your business record also needs to be active with your secretary of states.

Businesses that need the loan can fill their application form online or through the phone. All that is required in the supplication is your name, address and years of business. Additional financial information may be required, once your application is submitted. Within some few minutes of submitting your application, it can get preapproved, and once the loan is approved, you can then customize your loan term and amount you need, and finally get your funds.