What is a mortgage rate? A mortgage is a loan designed for buying a home. When the money is borrowed, a promise is made to repay the loan at an agreed-upon interest rate. A mortgage rate is the rate of interest charged on the mortgage. Mortgage rates are always determined by the lender and can either be fixed, staying the same for the period of the mortgage, or variable, fluctuating with a benchmark interest rate. That is the important mortgage rate borrowers are so interested in. it is just a factor and there is no doubt that the important thing to consider when you are trying to know how much a loan will cost you. To lend the money, the lender will charge an amount, expressed as an interest rate assessed for the term of the loan.

A mortgage is being set to help pay off the loan over a period known as the term. The most famous term is 30 years. It is a secured loan where the home is used as collateral. Are you interested in how today’s mortgage rates are calculated? Then this is a very big opportunity for you. That is because this article will tell you everything you need to know about mortgage rates today.

How are Mortgage Rate Set?

It depends; at the high-level mortgage rates are determined by economic factors that influence the bond market. You can’t do anything about that, however, it is worth knowing; the bad economy can move mortgage rates lower while Good news can push rates higher. What you can control is the amount of your credit score and down payment. The main point is that the bigger your down payment and the higher your credit score, generally the lower your mortgage rates.

How Often do Rates Change?

Mortgage rates can change daily, and most of the time more than once a day. The lenders have to let you know how currents are, so that you can always see when they were updated.

What are the mortgage rate trends for 2021?

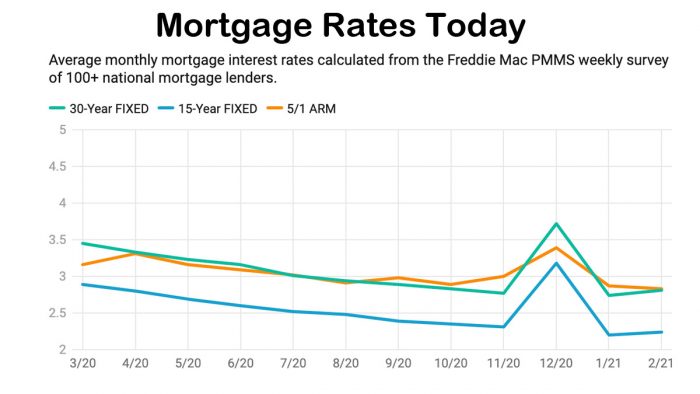

The expectation for mortgage rates in 2021 is that they will develop as the economy recovers. However, the economic recovery is unlikely to follow a line, so there will be ups and downs along the way. After commencing the year at a low record, the average 30-year mortgage rate climbed to 3.18% by the end of March. For the past month, rates are below 3% before moving higher at September. Although the long-term overall trend will be raising rates, there will be ups and downs from time to time. However, rates are expected to remain good months to come.

How are today’s mortgage rate calculated

Today rates are always based on different sets of details known as assumptions. The below include the sets of assumptions, check them out.

- A loan Amount

- Credit scores

- If by any chance refinancing, you are not taking cash out

- Debt to income ratio

- Closing cost will be paid up front

- You are buying or financing a single family home that is your primary residence.

The closer your details are to the assumptions, the more it is you will get a similar rate. However, when the rate changes the assumption can change too. And you need to know that assumptions are different from lender to lender. That is why it is advisable to check assumptions when comparing rates.