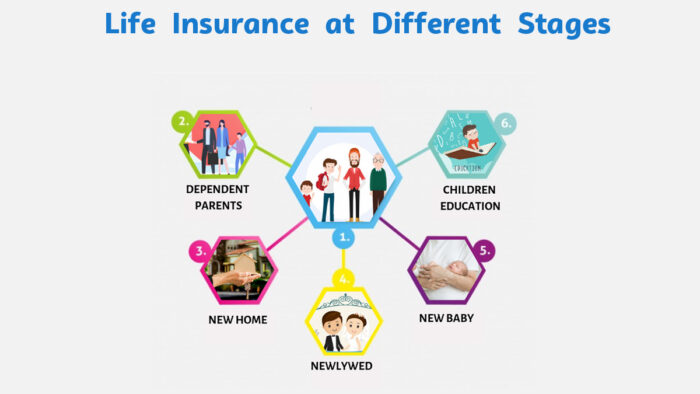

Life insurance may be required at different life stages during your lifetime. Whether you are single, just retired, or anywhere in between, life insurance can be a valuable tool in your financial toolkit.

Your requirement for life insurance fluctuates as your circumstances change. When you’re young, you normally don’t need life insurance, but this changes as you take on more responsibilities and your family expands.

Then, as your duties gradually shrink, your need for life insurance may decrease. Let’s look at how your life insurance needs alter over time.

Life insurance for different Life Stages

Life insurance for young adults

Unmarried adults of all ages usually do not consider getting life insurance. You are self-sufficient and do not rely on your partner or children for financial support. However, there are still solutions available for life insurance. If you have any loans, mortgages, or debts with a co-signer, your death would make your co-signer accountable for making the payments.

Another risk to avoid is delegating end-of-life expenses to your loved ones. Finally, if you find yourself financially supporting your elderly parents, you may want to look into cash-value life insurance to help create assets that you can utilize to supplement retirement income later.

Life insurance for newlyweds

Life insurance can be beneficial at this stage of life because you have added a spouse to your life. The first step is to determine how much coverage you require to replace future lost income and cover any substantial debts that would place a strain on your spouse. Begin by using our life insurance calculation tool, and then contact a financial advisor to discuss your results and future steps.

Life insurance for parents

As a parent, you are constantly looking out for your child’s best interests. Life insurance should be addressed when planning for the future. To get started, consider the future costs of raising your child, including higher education and coverage for a stay-at-home parent (if applicable).

Life insurance for empty nesters

Because your children are no longer living at home, you may not require as much life insurance as you formerly did, but it is still necessary if you are married and still working. At this point, it is advisable to consult with your financial advisor about estate planning to ensure you have all of your bases covered.

Life insurance for post-retirement

When your kids grow up and leave home, it’s a good idea to take another look at your life insurance. This time, you might want to think about getting a plan that gives you a steady amount of money every month, like a pension plan.

That way, when you retire and stop working, you’ll still have money coming in to pay for your everyday costs and any medical bills that might pop up. This can help you keep living the life you’re used to.

Here’s why you need life insurance

- Provide a safety net for your dependents, assuring them financial security in the event that you pass away.

- Protect your family against financial distress caused by outstanding obligations, such as house loans.

- Cover escalating medical expenditures and provide access to high-quality treatment.

- Make the distribution of your assets easier, reducing disagreements and legal complexity.

- Use life insurance to generate additional income and maintain financial freedom.

- Receive tax breaks on premiums and revenues, making it a tax-efficient option.

Life insurance for seniors: Golden Years

Even when you’re older, there are insurance plans made just for people like you. These plans can help pay for things like a funeral when you pass away. They can also give money to your family to help them out after you’re gone. This kind of insurance is sometimes called final expense insurance or senior citizen insurance. It’s a good way to make sure your family is taken care of, even after you’re no longer here.

Here’s why you need life insurance

- Provide your family with financial security by paying off debts, burial fees, and everyday needs in one single amount.

- Make the transfer of assets to your heirs easier, ensuring that your hard-earned money ends up where you want it.

- Tailored alternatives may cover medical bills, offering additional financial help for healthcare demands.

- Tax advantages include deductible premiums and tax-free benefits, which might help you manage your retirement taxes more effectively.

- Knowing that your loved ones are financially secure will give you peace of mind in retirement.

- Secure coverage with insurance developed specifically for seniors, which frequently need low or no medical exams.

Frequently Asked Questions

Why should young adults consider life insurance?

It can help you avoid passing on debt to your loved ones. Life insurance can protect your loved ones from inheriting student loan debt, mortgages, and other major bills.

Why consider a pension plan during the post-retirement phase?

Because it will give you financial stability by delivering a consistent income after retirement, allowing you to live without having to worry about money.

How do I determine the right life insurance coverage for my stage in life?

Your age, financial responsibilities, and future ambitions all influence the best life insurance policy for you. It is suggested that you examine your needs and speak with a financial counselor to find the most appropriate insurance for your unique life stage.