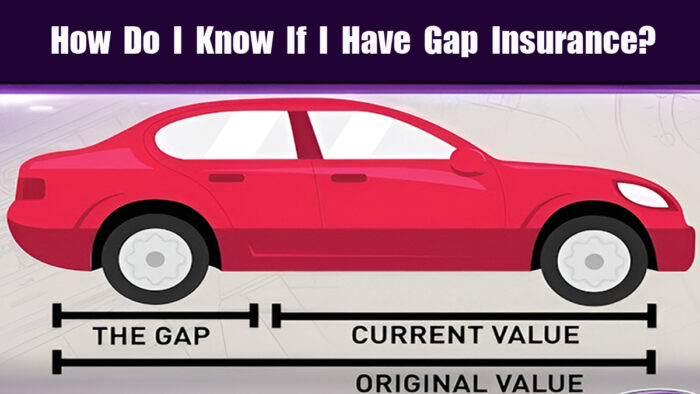

How do i know if I have Gap insurance? Gap insurance offers you additional protection in case your car is stolen or totaled. If your insurer declares your vehicle a total loss, this coverage will cover the difference between the actual value of the vehicle (ACV) and what you still owe on the vehicle.

In other words, Gap insurance covers the “gap between your lease balance or auto loan and the current market value of your vehicle, should it get stolen or totaled.

If your car is stolen or totaled in a covered accident, you’ll file a claim under your collision or comprehensive insurance. Your insurer will pay the actual cash value (ACV) of your car to your lender.

If you still owe more on your loan than the ACV, Gap insurance covers the difference. Now that you are clear on what this coverage is about and the functions that it serves, we can help you answer the question, “How do I know if I have Gap insurance?

Why is GAP Insurance Important?

For instance, if you take out an auto loan of $30,000 for your vehicle and it is worth about $27,000 at the time of the accident, your insurer will pay you $27,000. Your Gap insurance would come in and cover the remaining $3,000, so you don’t have to. Without this coverage, you will be responsible for paying the entire loan amount, even when the vehicle is not drivable anymore.

Do I Have Gap Insurance?

To know if you have Gap insurance in your policy or your loan agreement, check with your insurer or lender. Your insurer may include it in your policy as an add-on or from your lender as part of the loan agreement.

Your insurance provider should be able to inform you whether they offer this type of coverage and the price for it. While the lender will provide you with information about the terms of their loan agreement, ensure that you ask important questions and read all the documents well, so there won’t be surprises in the future.

How to Purchase Gap Insurance

Unlike liability insurance, this coverage is not compulsory for drivers. It is an optional level of coverage, so you would need to seek it out or ask for it and have it added to your car insurance policy. The only exception is that when you lease a vehicle, the agreement may require you to have coverage in case of a total loss.

Before you purchase the coverage, call your insurer to see if it is already included in your regular car insurance policy. Also, some lease and finance companies include Gap insurance with your lease or purchase. If you don’t want it, let them know up front.

Depending on your insurer, you can purchase the coverage as an add-on or separately through your auto lending company. Before you sign up for the coverage, make sure you understand what is covered and what is not in case of an accident.

Some policies will only cover specific types of accidents, so it is essential to read the fine print carefully before you sign up for the policy. Some of the companies that offer Gap insurance include:

- Allstate

- American Family

- Auto-Owners

- Erie

- Nationwide

- Progressive

- Shelter

- State Auto

- Travelers

- Westfield

Just so you know, not all auto insurance companies sell this coverage, and it may not be available in every state in the U.S. For example, Farmers and Geico don’t offer coverage.

Do I Need Gap Insurance?

Whether you need this coverage depends on how much you have left on your car lease or loan and how much the vehicle is worth. If you have a lot of money and don’t care about the gap, you likely don’t need Gap insurance.

For instance, if your car is worth $10,000 currently and you owe $12,000 on the car loan, you may be willing to make a difference if the vehicle is totaled. However, if you have a $30,000 auto loan on a $22,00 car loan, you may not be able to pay the $8,000 gap. In this event, you may decide to go for Gap insurance.