In the world of finance, one of the fastest ways to deal with financial emergencies is to take out loans. However, this may seem farfetched if you have a bad credit score, as most loan lenders tend to look at a borrower’s credit history before deciding whether or not to give out loans. But with a guaranteed loan, the likelihood of lenders using your credit score as a yardstick to give you a loan is completely eliminated.

What Is a Guaranteed Loan?

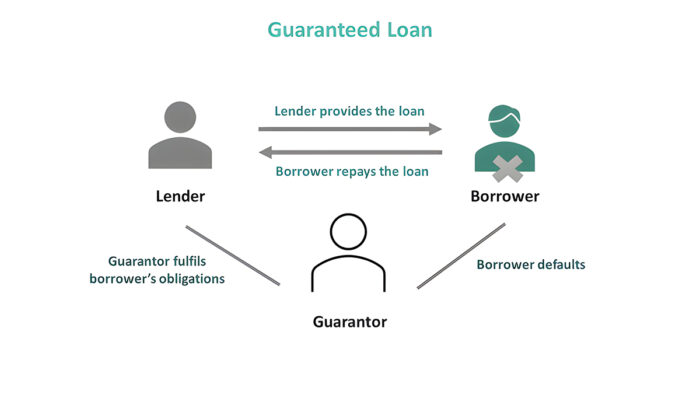

A guaranteed loan is a type of loan in which a third party, such as a cosigner or guarantor, agrees to take responsibility if a borrower defaults on a loan. It is basically designed for borrowers with little or no credit history.

As such, it does not require a credit check and is always guaranteed to be approved. They are typically backed up by the Federal Housing Administration [FHA] or the Department of Veteran Affairs [VA].

How Does a Guaranteed Loan Work?

A guaranteed loan is an alternative for individuals who couldn’t qualify for conventional loans as a result of their credit score. It is aimed at people who need urgent cash to settle financial emergencies.

On the contrary, guaranteed loans could spell disaster for borrowers, given the high interest rates that come with them. Loans with instant approvals, like guaranteed, are typically small and have shorter repayment terms, which could be a recipe for a debt spiral.

More often than not, people who borrow guaranteed loans find it difficult to pay them back. Hence, they have to borrow another loan to repay the first. On the other hand, you get instant approval and do not have to go through the usual loan application process.

Types of Guaranteed Loans

In this section, we’ll show the types of guaranteed loans and how they work.

• Federal Student Loans

One of the types of guaranteed loans is a federal student loan. A federal student loan is a type of loan provided by the U.S. Department of Education to help students and their parents cover the costs of education.

These loans typically do not require a credit check. They offer more favorable terms and conditions compared to private loans and are subject to specific regulations and eligibility criteria set by the government.

• Payday Loans

Payday loans are short-term loans that typically don’t require a credit check. They are usually based on your income and ability to repay.

Keep in mind that payday loans often have high interest rates and fees. So, it’s important to carefully consider the terms before agreeing to one.

• Title Loans

With a title loan, you use your vehicle as collateral. The lender doesn’t typically perform a credit check because they have the security of your car if you fail to repay.

Be cautious with title loans, as they come with the risk of losing your vehicle if you can’t repay them.

• Pawn Shop Loans

You can use valuable items like jewelry, electronics, or other possessions as collateral for a loan from a pawn shop.

Like title loans, pawn shop loans don’t usually require a credit check, but the risk is losing your item if you can’t repay the loan.

FAQs

What Types of Loans Can Be Guaranteed?

Guaranteed loans can cover a wide range of loan types, including business loans, student loans, and housing loans. The specific requirements and terms can vary depending on the type of loan and the guarantor involved.

Who Is Eligible For a Guaranteed Loan?

Eligibility criteria vary depending on the type of loan and the guarantor. In many cases, guaranteed loans are designed to assist individuals or businesses that may have difficulty obtaining traditional financing due to factors such as a limited credit history or insufficient collateral.

Are Guaranteed Loans Risk-Free for Borrowers?

While guaranteed loans can be more accessible for borrowers, they are not entirely risk-free. Borrowers are still responsible for repaying the loan, and failure to do so can have consequences, including damage to credit scores and potential legal action.

Can Guaranteed Loans Be Used for Any Purpose?

The purpose for which a guaranteed loan can be used depends on the terms set by the lender and the guarantor. Some loans may have specific purposes, such as starting or expanding a business, while others may be more flexible.

How Can I Apply for a Guaranteed Loan?

The application process for a guaranteed loan varies depending on the lender and the type of loan. Generally, it involves submitting an application, providing necessary documentation, and meeting the eligibility criteria set by the lender and guarantor.

What Happens If I Default on a Guaranteed Loan?

If a borrower defaults on a guaranteed loan, the guarantor will step in to cover the outstanding balance. However, the borrower may still face negative consequences, such as damage to their credit score and potential legal action. It’s important for borrowers to understand the terms of the loan and work with the lender to find solutions if they encounter financial difficulties.

Are Guaranteed Loans Secured or Unsecured?

Guaranteed loans can be either secured or unsecured, depending on the specific terms and conditions of the loan agreement. The term “guaranteed” typically refers to the fact that the loan is backed by a guarantee, often from a third party such as a government agency or a private entity.

Secured Guaranteed Loans:

In some cases, guaranteed loans are secured, meaning that the borrower provides collateral to back the loan. Collateral could be an asset such as real estate, a vehicle, or other valuable property. If the borrower fails to repay the loan, the lender can seize the collateral to recover their losses.

Unsecured Guaranteed Loans:

On the other hand, guaranteed loans can also be unsecured. In this case, there is no specific collateral tied to the loan. Instead, the guarantee comes from a third party that promises to cover the loan if the borrower defaults. Unsecured guaranteed loans often rely on the financial strength and creditworthiness of the guarantor.

It’s important to carefully review the terms and conditions of any loan agreement to understand whether it is secured or unsecured and what type of guarantee is provided. Different lenders and loan programs may have varying requirements and structures for guaranteed loans.