What are Fringe Benefits?

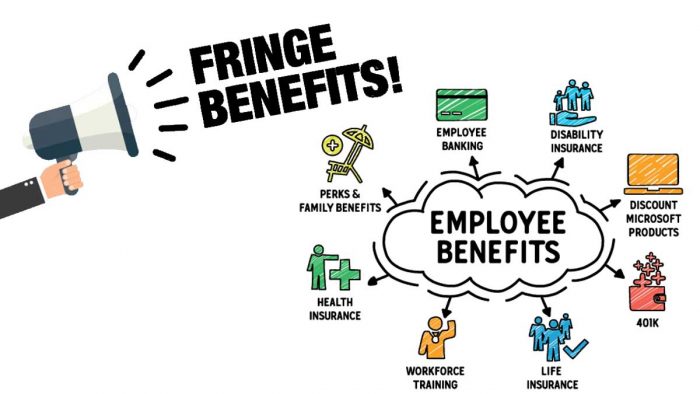

You probably have heard of Fringe Benefits, but you don’t exactly know what it’s all about. In this review, we will go over Fringe Benefits, how it works, the different types of it, and everything you need to know about it. Fringe benefits refer to benefits provided to employees in addition to their declared compensation for performing a certain service. In simple terms, it means additional benefits offered to an employee above the stated salary for the performance of a specific service. To name a few, they may include: a corporate car; medical insurance; dental and vision insurance; paid vacations; a pension plan; a housing allowance; and more.

Meanwhile, fringe benefits may be mandated by law, awarded unilaterally by employers, or negotiated through collective bargaining. For instance, benefits such as social security, health insurance, and a paid pension are required by law. While benefits such as free breakfast and lunch, gym membership, and transportation. Also, education assistance, retirement planning services, childcare, and more are optional. One of the perks of fringe benefits is that they are tax-free for the employer, provided the required requirements are met. It’s worth noting that, according to the IRS, any taxable benefit must be included in the receiver’s salary unless the legislation specifically exempts it.

Type of Fringe Benefits

There are two types of fringe benefits available. Some benefits are mandated by law, while others are supplied at the discretion of the employer. However, in this section of the article, we will be provided with the various types of benefits. Hence, here are some of the popular and well-known types of benefits.

- Stock options for employees.

- Free or reduced-price lunches.

- Free access to the gym.

- Assistance with transportation.

- Contributions to retirement plans.

- Company cell phone.

- Paid sick days.

- Expenses of relocation.

- Free or low-cost lodging

- Assistance or a tuition reduction.

- Insurance for life, dental, and vision.

- Reimbursement for childcare.

- Vehicle owned by the company.

- Unlimited paid vacation time (PTO).

- Amusement park tickets at a discount.

The above listed are some of the most popular types of Fringe Benefits offered by companies across various states and regions of the world.

How Does Fringe Benefits Work?

Fringe benefits, as mentioned, are additional benefits provided to an employee based on a particular service performed. However, benefits offered from company to company vary, enabling employees to select benefits that will be supplied. During the recruitment process, employees are allowed to select a fringe benefit that they are interested in. Whether it’s a company car, college financial support, or a paid gym membership program, employees are free to choose from the various options.

Moreover, this is done to provide the employee with maximum comfort in their current position within the company. Other benefits such as employee discounts, gifts, no-cost services, and more can also offer to employees, especially by retail firms. While providing fringe benefits to employees is designed to make them feel more at ease at work. It also helps the company stand out to potential employees.

Employers may find it difficult to retain top personnel based only on salary in highly competitive marketplaces. Additional compensation is provided via fringe benefits. However, providing your staff with a distinctive fringe perk helps the business stand out from the competition. Also, it gives you a better chance of attracting high-value and bright individuals from schools or other businesses.

Frequently Asked Questions?

Are Fringe Benefits Taxable?

Yes, most fringe Benefits come taxable but the law can exclude certain benefits and this can either come as partially or entirely. According to the IRS Employer’s guide, any taxable benefits must include or have added to the recipient’s pay unless the law specifically excludes it.

What Benefits are not taxable by the Law?

However, based on the same IRS Employer’s guide, some of the fringe benefits that are not taxable by the law include;

- Accident and Health Benefits

- Achievement Awards.

- Adoption Assistance.

- Athletic Facilities.

- De Minimis (Minimal) Benefits.

- Dependent Care Assistance.

- Educational Assistance.

- Employee Discounts.

- Employee Stock Options.

- Employer-Provided Cell Phones.

- Group-Term Life Insurance Coverage.

- Health Savings Accounts.

- Lodging on Your Business Premises.

- Meals.

- No-Additional-Cost Services.

- Retirement Planning Services.

- Transportation (Commuting) Benefits.

- Tuition Reduction.

- Working Condition Benefits.

The above-listed benefits include nontaxable by law, but they are subjected to certain conditions which must be met. You should be able to meet the needed requirements and conditions before you can access most of the above-listed benefits.