The FED Rate Increase going to affect everyone directly or indirectly. Furthermore, the announcement of this rise was on Wednesday afternoon. The reason for the increase in federal fund rates is to defeat and combat inflation in the economy. Moreover, the announcement was made by the Federal Reserve. What’s more, they informed people to be prepared for the fourth spike in the rates by 0.75%. But with this hike in the rates, they work to reduce inflation but with the plans of making borrowing more expensive and pricier.

However, due to the FED rate increase, a lot of things will be affected and become more expensive than ever. In other words, there are going to be losers and winners from this rate hike in the United States. In addition, this decision is said to be the fourth straight time that the Federal Reserve has raised the fed rates. The central bank also has a hand in this and is supporting the idea of finally getting rid of high inflation in the economy.

When Was The FED Rate Increase Announcement?

The FED rate increase was announced to the public on Wednesday afternoon. So, the purpose of this raise is to cancel and revoke inflation in the economy.

How Many Times Have The FED Raised Rates In 2022?

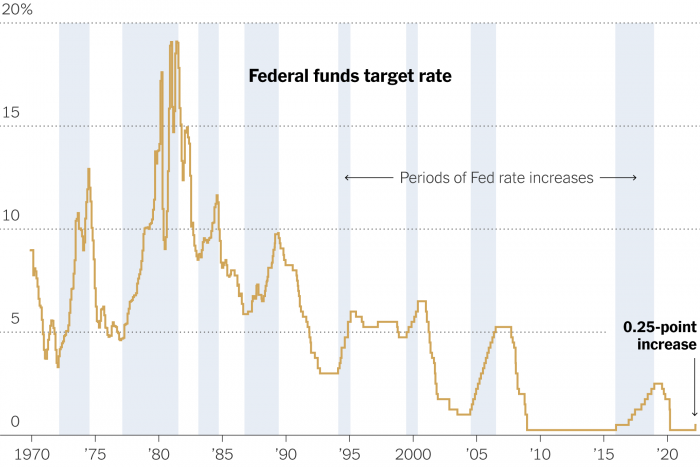

Before the FED plans on increasing rates, they have meetings before executing the first decision. But in 2022, these rates have increased by 3% in roughly six months.

| MEETING DATE | FEDERAL FUNDS RATE | RATE CHANGE (bps) |

| March 17, 2022 | 0.25% – 0.50% | +25 |

| May 5, 2022 | 0.75% – 1.00% | +50 |

| June 16, 2022 | 1.5% – 1.75% | +75 |

| July 27, 2022 | 2.25% – 2.5% | +75 |

| September 21, 2022 | 3.00% – 3.25% | +75 |

| November 2, 2022 | 3.75% – 4.00% | +75 |

Who Will Be Affected By The FED Rate Increase 2022?

As mentioned, there are a lot of people that will be affected by the rate hike slightly and heavily. In other words, this rate increase is going to affect some of the departments in the economy making money, products, and services more expensive. They include:

- Credit cards.

- Mortgages.

- Stock and bond investors.

- Borrowers.

- Savings accounts.

Credit Cards

With the FED rate increase, credit cards are one of the things that will become expensive. Moreover, if you are making use of a variable-rate credit card, your charges will change and become more expensive.

Moreover, this is also based on a prime rate that is similar to the federal funds rate. In other words, these variable-rate cards will become expensive and higher in price. But do not put your mind permanently on this increase because it is still rising.

So, as a cardholder or user, you are expected to begin to see your debit or credit cards go to 19% and 20% probably in the nearest future. If you want to survive during these months, you have to make use of zero or low-rate balance transfer offers.

Mortgages

Due to the FED rate increase, one of the things that will become expensive and higher in the economy is Mortgage. Furthermore, the interest rates on these mortgages will also rise as well. However, this is because they are also influenced and affected by the bond market.

Moreover, you also need to be expecting that 30-year fixed mortgage rates will move from 7% to 7.25% if the rate increases again.

Stock And Bond Investors

Stocks will continue to be stable if the fed’s rate is close to zero. However, now that this rate has skyrocketed, so will stocks and bonds. When stocks and bonds are low, companies will like to invest for instance, CDs.

Sadly, this rare increase is making investors worried about if it will ever come down and how low stocks are falling as well. Besides, a high rate will not be good news to any of these investors who are into bonds and stocks.

Borrowers

New and existing borrowers will highly be affected by the FED rate increase. But this hike will not affect existing borrowers intensely. For example, if you have a 30-year fixed-rate mortgage in 2021 or earlier in 2022, then, you are safe

However, if you are making plans to borrow a mortgage this year, then it is not a good idea. So, matter the type of loan you are going for, it is not a good idea.

Savings Accounts

The FED rate increase will also affect savings accounts. Interest rates are not exceptions with the hike in rate. Moreover, since these rates have increased, banks will also increase their rates on accounts and CDs as well.

However, do not believe that it will end here because there may still be more increases in the future. In addition, do not feel bad because the Federal Reserve as well as the central bank are trying to eradicate inflation.

Will Fed Rate Increase Again?

Yes, the first decision on the increased rate has been executed. So, we will be expecting more news from the feds soon.

When Is The Next FED Rate Increase Date?

I am sure you already know that the FED rate has increased by 0.75 percent. However, this was at its last three meetings. Plus, there are two more policy decisions to make. So, the next FED rate increase schedule will take place from November 2 and December 14, 2022.