It is very important that you have sufficient protection against unpredictable events in the world of insurance. Even though businesses and individuals navigate through the complicated landscape of insurance quotes, it can be daunting when it comes to understanding their coverage options. One of the popular options that arises when we talk about comprehensive risk management is excess liability coverage.

What is Excess Liability Coverage?

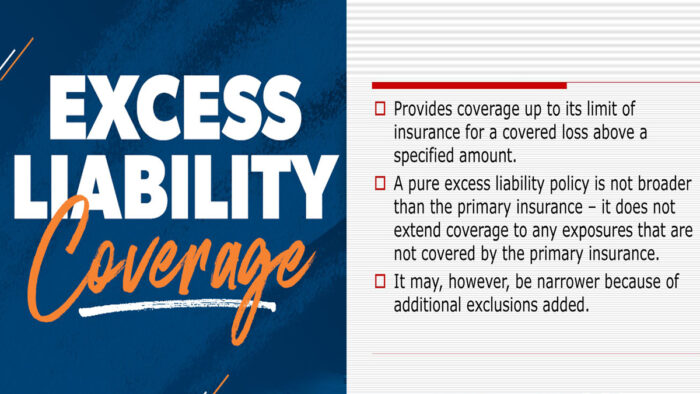

Excess liability coverage is a form of insurance coverage that exceeds a primary liability policy’s limit. For instance, general liability insurance, auto insurance, or homeowners’ insurance.

Excess liability coverage offers an extra form of protection against lawsuits or disastrous events that exceed the coverage limits of your policy.

How Does It Work?

Excess liability coverage offers coverage for costs that surpass the limits of primary insurance quotes. For instance, if a liability claim against you or your business surpasses or exceeds the liability limit of your auto or homeowners insurance policy, with excess liability insurance, you do not have to worry about the remaining expenses or costs because they will be covered by this form of insurance.

What Does Excess Liability Coverage Cover?

If you have excess liability coverage, here are the wide range of liabilities that you will receive coverage for:

- Medical expenses.

- Bodily injury.

- Property damage.

- Legal fees.

- Worldwide coverage.

- Slander

- Invasion of privacy.

- Defamation lawsuits.

- Court costs.

What Does It Not Cover?

Although excess liability insurance covers a wide range of events, there are some exclusions, which include:

- Business activities.

- Intentional acts.

- Specialized liabilities.

- Contractual obligations.

- Certain high-risk activities.

Who Needs a Policy?

If your only interest is to safeguard your future earnings and assets from possible liabilities that are higher than those in your standard insurance quote, you will find excess liability insurance quite beneficial. These also include:

- High-net-worth individuals.

- Professionals with valuable assets or high exposure to liability risks.

- Business owners.

- Vehicle owners.

How Much Does Excess Liability Coverage Cost?

There are various factors that affect the cost of excess liability insurance. They include:

- Insurance company.

- Coverage limits.

- Underlying policies.

- Claims history.

- Driving record.

All of these factors play an important role in determining the premium amount for this type of insurance.

How to Get Excess Liability Coverage

Here is what you need to do to purchase excess liability insurance from any insurance provider of your choice, whether you have renters, auto, or homeowners insurance:

• Assess your needs

Review your current insurance coverage and assets to find out how much additional liability coverage you need.

• Contact your insurance company

Contact your insurance provider or company to ask about excess liability coverage options and find out if they are part of your existing policy.

• Compare Policies

Shop around for policies and compare them from various insurance providers to find the suitable coverage for your needs.

• Review the details of your policy

Check the terms and conditions of the excess liability policy carefully to understand what is covered and its exclusions.

• Consider additional coverage

You might want to consider extra coverage options like uninsured or underinsured motorist coverage, PIP, and others for extra protection.

• Bundle policies

Ask about bundle policy discounts from the same insurance company you are using to save money on your purchase.

• Collaborate with an insurance agent

If you are not sure about the best coverage option for your needs, you can work with a professional insurance broker.

• Review and update regularly

Review or check your existing insurance coverage regularly to make sure that you are still getting coverage that meets your needs.

Frequently Asked Questions

Do I need excess liability coverage if I already have homeowners or auto insurance?

Although auto and homeowners insurance already offer liability coverage, their limits may not be enough to cover policyholders against disastrous losses. But with excess liability insurance, you have that additional layer of protection.

Is excess liability insurance tax-deductible?

Sometimes, the premium amount paid for coverage from an excess liability coverage policy may be tax-deductible and subject to specific conditions and limitations. This is why it is better to speak to a tax advisor for advice.

Can I increase my coverage limits over time?

Yes, it is 100% possible for you to increase and adjust your coverage limits as time goes on. But you will need to reach out to your insurance company or provider and ask for a quote adjustment and review.