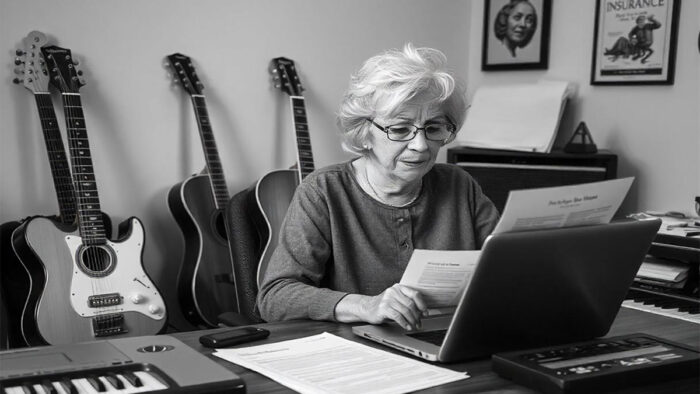

Not only are musical instruments tools used to showcase creativity, but they may also be very expensive and have great sentimental worth. The issue of whether you need insurance for musical instruments is one frequent question most people ask. Regardless of whether you are a professional musician or a casual instrument player, it is often wise to consider insurance to safeguard your musical instruments.

Musical instruments can sometimes be prone to theft, damage, or loss, thereby making insurance a vital component for safeguarding them.

Do You Need Insurance for Musical Instruments?

Yes, getting insurance for your musical instruments can be important, especially if they are pricey or have a lot of personal significance. Typically, musical instruments are investments that are worth protecting. Insurance can shield you against hazards like loss, damage, or theft, allowing you to replace or repair your instruments without having to pay a large amount out of yourself. Professional and amateur musicians tend to spend a lot of money maintaining their musical instruments, so getting insurance is a smart investment.

There are many types of coverage available for insuring musical instruments. If you have a homeowners or renters insurance policy, you may be covered under personal property coverage; it all depends on the terms of your insurance policy. Some insurance companies require policyholders to separate coverage for their musical devices from their normal insurance policy.

Above all, the worth of your musical instruments, how often you use them, and your risk tolerance largely determine whether or not you need insurance.

How Can I Make Sure My Musical Instrument Is Adequately Covered?

Depending on your insurance company and the type of policy you have, you might be allowed to include coverage for musical instruments as a rider to your existing policy. If you have a home, renters, or condo insurance policy, there is a possibility of scheduling your musical instrument to ensure maximum coverage.

However, it is important to note that, by adding a rider to your policy, you will most likely be charged a higher premium since you seek coverage that goes beyond the limit of your existing policy.

Additional Coverage For Insuring Musical Instruments

If coverage for musical equipments is not available in your homeowners, renters, or condo insurance policy, worry less! There are several commercial insurance policies you can take advantage of to ensure maximum protection for your musical instruments. Some commercial insurance policies are specifically designed to offer coverage to musicians and instrumentalists who earn a living with musical instruments.

For instance, some insurance companies offer business interruption coverage that protects musicians in the event that their musical instruments get lost or damaged. You can also be covered by borrowed instruments or rental reimbursement if your musical instrument was damaged before use.

How Can I Save Money on Musical Instrument Insurance?

The fact remains that the cost of coverage for an insurance product varies significantly across insurance companies. While you may be charged a higher premium for coverage from an insurance company, it is possible to get a lesser and better rate from another. A very good way to save money on musical instrument insurance is by doing research, shopping around, and comparing quotes from more than three insurance companies.

In the process of shopping around, pay close attention to the company’s terms and conditions, including the type of coverage they offer. Dome insurance companies may have restrictions on the applicability of coverage for musical instruments, such as the location where your instrument is kept and its type.

If you are on the lookout for an insurance company that covers the cost of repair and replacement of damaged or lost musical apparatus, ensure to check if the insurance company you are settling for offers this kind of protection. This would ultimately save you from the financial burden that comes with repairing or replacing a damaged instrument.

Do I Need Public Liability Coverage?

Public liability coverage can be an ideal option for professional musicians. If someone gets injured or you damage someone’s property while performing, public liability cover will protect you and help sort out all related expenses. When buying musical instrument insurance, ensure this is included in the coverage, as it helps to guarantee projection from third-party claims and other types of damage.

What Are The Best Music Instrument Insurance Companies In The UK?

If you reside in the UK and you intend to get insurance for your musical instruments, highlighted below are some reputable insurance companies you can buy coverage from:

- Allianz

- Segurio

- Lark Music

- Gallagher

- We Love Musicians

Bottom line

To sum it up, purchasing insurance for your musical instruments can offer priceless peace of mind as it shields your investments from unanticipated events like loss, damage, or theft.

Whether you are a professional musician or just venturing into music, having the proper coverage can protect your instruments and guarantee that you can keep making music without financial worries. You can weigh your options by evaluating the type of risk you are prone to, your insurance options, and the worth of your musical equipments