Finding affordable car insurance after a DUI can be challenging, but it’s crucial to maintain proper coverage to protect you financially. Some insurance companies specialize in providing coverage for high-risk drivers with DUI convictions.

These insurers set themselves apart by offering competitive rates, flexible payment options, and personalized service tailored to the unique needs of those with a DUI on their record.

This article will explore the best car insurance options for drivers with a DUI conviction in 2024. By comparing rates, coverage options, and customer service, we’ll help you make an informed decision to ensure you’re adequately protected on the road while working to rebuild your driving record. With the right insurer, you can find affordable coverage and regain your confidence behind the wheel.

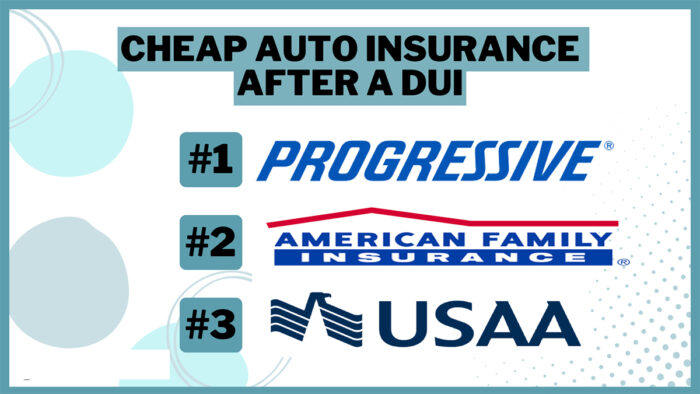

8 Cheapest Car Insurance After a DUI

Below the the top 8 companies that offers the cheapest car insurance after a DUI:

1. Progressive

Progressive is one of the companies that offers the cheapest car insurance with competitive rates for high-risk drivers, including those with a DUI conviction. It provides flexible payment options and a simple online quote process. Progressive’s “Name Your Price” tool allows customers to find coverage based on their budget. Their Snapshot program rewards safe driving habits, helping drivers reduce premiums over time.

2. American Family Insurance

American Family Insurance is known for its personalized approach to car insurance, making it a good option for those with a DUI. This mutual insurance company offers competitive rates, various discounts, and local agents who provide exceptional customer service. American Family helps customers choose the right coverage for their needs while considering their unique situation.

3. USAA

USAA is known for its excellent customer service and competitive rates for military personnel and their families. It caters to high-risk drivers, including those with a DUI, and offers tailored coverage options for the military community. USAA’s strong reputation for serving military members and veterans makes it a reliable choice.

4. Auto-Owners

Auto-Owners is known for its reliable coverage options and competitive rates for drivers with a DUI conviction. It provides a variety of discounts, including safe driving and multiple policy discounts, helping customers save on premiums. Auto-Owners offers personalized service through local agents, ensuring customers find the coverage they need.

5. State Farm

State Farm is known for its extensive network of local agents who provide personalized support for high-risk drivers, including those with a DUI.

Currently the largest car insurance company in the U.S., it offers competitive rates and various discounts, such as safe driving and good student discounts. With a strong reputation for financial stability, State Farm provides dependable coverage options.

6. Nationwide Insurance

Nationwide Insurance is known for offering competitive rates and reliable coverage for drivers with a DUI. Their SmartRide program rewards safe driving habits with discounted rates. It provides a user-friendly online experience and excellent customer service, making it a convenient choice for high-risk drivers seeking coverage after a DUI.

7. Erie Insurance

Erie Insurance is known for its competitive rates and personalized service through local agents. They offer flexible coverage options and various discounts, including safe driving and multi-policy discounts. Erie provides dependable coverage options for high-risk drivers, helping them find affordable insurance after a DUI.

8. GEICO

GEICO is known for its affordable rates and wide range of discounts, making it an attractive option for drivers with a DUI conviction. Discounts like safe driving, military, and good student can help lower premiums. GEICO’s easy-to-use website and mobile app allow customers to manage their policies effortlessly.

Frequently asked questions

Can I get car insurance after a DUI?

Yes, it is possible to get car insurance after a DUI conviction. However, your options may be more limited, and premiums will likely be higher due to the increased risk associated with DUI drivers.

How much will my car insurance rates increase after a DUI?

Rate increases vary based on factors like location, age, and driving history. On average, premiums can increase anywhere from 50% to 200% or more after a DUI conviction.

How long will a DUI affect my car insurance rates?

A DUI can impact your car insurance rates for 3–10 years, depending on your location and insurance company. In some cases, it may take up to 10 years for your rates to return to pre-DUI levels.

Do I need an SR-22 form after a DUI?

Yes, most states require an SR-22 form as proof of insurance after a DUI conviction. This form certifies that you have the minimum required liability coverage.

How can I lower my car insurance rates after a DUI?

Improve your driving record, maintain continuous coverage, consider a defensive driving course, and shop around for better rates to potentially lower your car insurance premiums.

When should I start looking for car insurance after a DUI?

Start searching for car insurance as soon as possible after a DUI conviction to ensure you have adequate coverage. Comparing rates and options will help you find the best coverage.