The word “annual percentage rate” is mostly used for lending products such as personal loans, credit cards, and mortgages. The annual percentage rate, or APR, on a personal loan is the combined total of the interest rate and the origination fee, calculated every year and expressed as a percentage. If there are no origination fees or other fees, the APR equals the interest rate.

In other words, the annual percentage rate is one of the factors to consider when you want to apply for a personal loan or other type of credit.

It combines any set fee and interest rate, such as origination fees, that your lender charges. APR varies depending on the loan amount as well as the lender you choose, credit score, income, and other factors.

How Does Annual Percentage Rate Work on a Personal Loan?

When it comes to personal loans, the APR is like comparing apples to apples. Just looking at the interest rate or monthly payment doesn’t give the full picture or view. Personal loans have a fixed interest rate. This means it stays the same for the whole loan. You pay back the loan each month for two to seven years in equal amounts.

The interest rate you get is based on stuff like your credit score and how much debt you have compared to your income. At times, there’s an origination fee, which can be 1% to 10% of the loan amount.

They look at things like your credit score and how much you’re borrowing to figure this fee out. When you add up the interest rate and fee, you get the APR. Before you officially apply for a personal loan, most lenders allow you to check your estimated APR without affecting your credit score.

What is a Good APR on Personal Loans?

A good APR on personal loans is one below the national average. However, if you qualify for it, you will need to have a credit score above 670 and a good source of income. Or you should meet a creditworthy co-signer that meets all of these requirements.

Having a low APR will help you save money over the life of a loan. For instance, if you borrow $10,000 for 5 years, you will pay about $3,000 less with an APR of 8 percent versus an APR of 18 percent.

How APR for a Person Loan is Calculated

To calculate the annual percentage rate, lenders take the personal loan interest rate and add in the finance charges. This includes origination fees and any other fees. Most lenders list their APR on their website. If you want to calculate the numbers by yourself, follow the below steps:

- Add up the loan fees and interest rates.

- Divide the figure you get by the principal balance or original loan amount.

- After that, divide the result by the loan’s term number of days.

- Multiply this figure by 365.

- Once you have done that, multiply the resulting figure by 100 to turn the number into a percentage.

You can make use of various online loan APR calculators to get this percentage if you want the calculations to be very simple.

Annual Percentage Rate vs. Interest Rate on a Personal Loan

Although interest rate and APR are most often used interchangeably, they are not the same thing. The interest rate is the amount that is charged when you borrow money. They are expressed as percentages and can be amortized or very simple.

The annual percentage rate, on the other hand, is the combination of fees and interest rates. This is always higher than the interest rate.

If lenders do not charge any other fees, then the APR will be the same as the interest rate. However, no-fee loans are very rare. The APR is just to help you get a view of how much your loan will cost. But this is just one of many things you need to consider while comparing personal loans. Other factors include loan term, eligibility, fees, and other additional features.

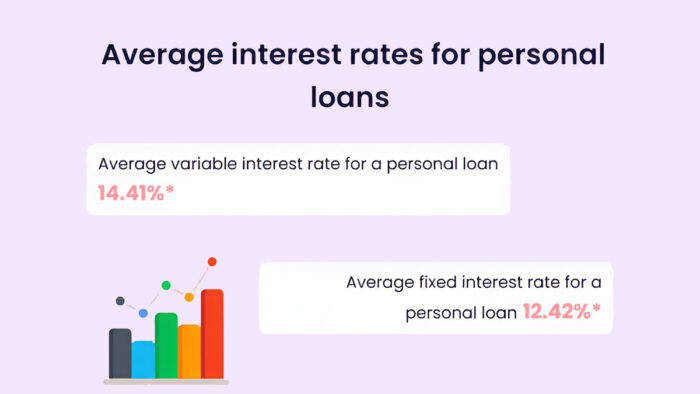

What is the Average Annual percentage Rate on a Personal Loan?

APR can be based on various factors, such as credit score, annual income, loan term, and debt-to-income ratio. The average percentage rate for a personal loan can range from 8% to 36%. According to research, the average APR for a personal loan is about 12% as of 2024.

How Can I Get a Low Annual Percentage Rate on a Personal Loan?

When it comes to personal loans, APR is one of the most important factors you need to consider. It will help you know the overall cost of the loan you want to borrow. A stable source of income, a low DTI ratio, and a good credit score can all help you get a low APR.

Even if you have a less than perfect credit score, you can still get a good loan by choosing a lender that offers bad or fair credit loans or by applying with a co-signer or co-borrower. If you don’t have a joint applicant or co-signer, compare bad credit loan rates before you apply to get the most affordable deal available.