As a business owner, you need key person life insurance if you want the utmost protection for it. Besides, a key person can be a person with hard-to-replace skills, a partner, or an executive. Without a doubt, if that person passes away, it can affect your business negatively. Hence, this is the importance of an insurance policy. If you are a business owner, key person life insurance is an essential asset for you.

What Is Key Person Insurance?

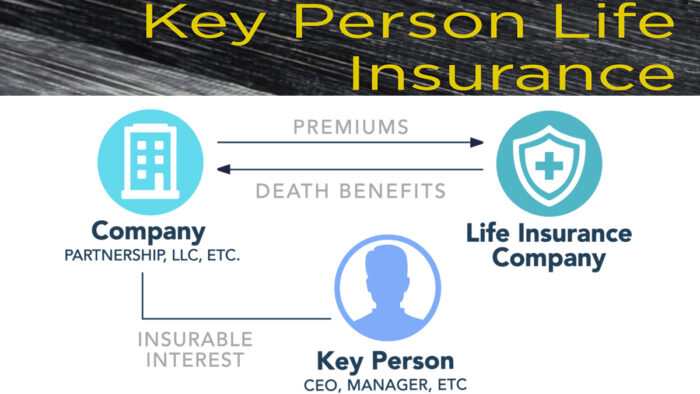

Key person insurance, also known as keyman insurance, is a type of life insurance policy that companies purchase for the life of an owner, person, or top executive that is considered important to the business.

Thus, the company will be paying the premiums and is also the beneficiary of the quote. Other forms that this insurance type is recognized for include business life insurance and key woman insurance.

How Does It Work?

The purpose of key person life insurance is to provide a financial cushion if there is a loss of a particular person, which will have a negative impact on the company as well as its operations. So, with the death benefit from the keyman insurance policy, it will give the company some time to find a new individual or develop new strategies to save the business.

For small businesses, the key person is normally the founder, owner, or one or two key employees. However, the most important point is whether the absence of the person will cause huge financial harm to the company. If this is the case, then you need to purchase a keyman insurance policy.

Additionally, Keyman Insurance also offers disability coverage if a person is no longer capable of working. As a business owner, you will pay premiums and also receive benefits after the person passes away. In other words, the company is the beneficiary of the quote or policy.

Types of Key Person Insurance Policies

Keyman insurance is very similar to individual life insurance.

• Key Person Term Life Insurance

Key-person term life insurance is designed to offer coverage to the insured or policyholder for a particular term or period. What’s more, this usually takes 10 to 30 years. Nonetheless, key person term life insurance is more affordable than the key person permanent life insurance quote. However, once the term for this type of key person life insurance policy is up, it cannot be renewed.

• Key Person Permanent Life Insurance

Key Person permanent life insurance policies never expire, just as long as you continue to pay the premiums. In other words, this policy covers the policyholder for a lifetime and might provide benefits while the key person is still alive.

• Variable Life Key Person Insurance

This type of insurance is very similar to whole-life insurance. This is because the insurance policy remains active as long as you make payments for your premium. But one difference is that the premiums will be put into an investment account instead of a savings account.

• Disability Key Person Insurance

With disability key person insurance, you can include a disability insurance component in your key person insurance quote. Therefore, the insurer or insurance company will pay a benefit, often 40% to 70% of the key employee’s monthly pay.

What Does Keyman Insurance Cover?

Keyman Insurance provides coverage for financial losses that may arise from the death or disability of the insured individual. It can help cover costs such as hiring and training a replacement, loss of profits, paying off debts, or reassuring investors and creditors.

Keyman insurance policy gives death benefits to business owners who have lost a key person in their organization. This is to continue the productivity and operation of the company and ensure that there are no setbacks due to the death of the employee. So, if you get the funds, they can be used for various purposes, like paying off debts, daily operational costs, and training a new hire.

What Does It Not Cover?

Just like other insurance policies, there will be some exclusions that can cause death and disabilities for the key person. These are the common exclusions that are included in a keyman insurance policy:

- Pre-existing conditions

- Dangerous activities

- Fraud

- Suicide

So, it is important that you read through your insurance policy’s agreement to check what is covered and what is not part of their coverage.

How Much Does Key Person Life Insurance Cost?

There are different factors that affect the cost of a key person life insurance policy. For example, the coverage amounts and the risk involved with the person you want to insure determine the cost of this insurance quote. Nonetheless, the average cost of a key person life insurance quote is $68 per month and $816 per year.

Other factors include:

- The key person’s role

- Size of the business

- Gender

- Nature of the business

- Lifestyle

- Age

- Health

How to Get Keyman Insurance

Buying or getting keyman insurance is similar to that of other insurances. This means that you will have to reach out to an insurance company or an agent if you are interested in a quote. But first, make sure that you find out your business needs and the options available to you before choosing.

FAQs

Who is Considered a Key Person?

A key person is typically someone whose contribution to the business is essential to its success. This could be a founder, CEO, top salesperson, or any individual whose expertise, knowledge, or leadership is crucial for the operation of the business.

How is the Coverage Amount Determined?

The coverage amount for key person insurance is usually based on the financial impact the loss of the key person would have on the business. Factors such as the individual’s role, salary, value of their contributions, and potential expenses in finding a replacement are taken into consideration.

Who Owns the Policy and Pays the Premiums?

In most cases, the business owns the keyman insurance policy and pays the premiums. However, the insured individual’s consent is typically required, especially if the policy involves medical underwriting.

Is Keyman Insurance Tax-Deductible?

In many jurisdictions, premiums paid for keyman insurance may be tax-deductible as a business expense. However, tax laws vary by location, so it’s important for businesses to consult with tax professionals or legal advisors for specific guidance.

What Happens if the Key Person Leaves the Company?

If the key person leaves the company, the business may choose to cancel the policy or transfer it to cover a new key person. Some policies offer flexibility in updating the insured individual without having to cancel the policy entirely.

Can Keyman Insurance be Used for Other Purposes?

While the primary purpose of key person insurance is to protect the business from financial loss due to the death or disability of a key individual, some policies may have additional features that allow for cash value accumulation or use as collateral for loans.

Is Keyman Insurance Necessary for All Businesses?

Key person insurance is particularly important for businesses heavily reliant on one or a few individuals whose absence could significantly impact operations or finances. However, its necessity varies depending on the structure, size, and nature of the business.

How Can a Business Obtain Keyman Insurance?

Businesses can typically purchase keyman insurance from insurance companies or through insurance brokers. It’s important for businesses to evaluate their needs, compare policies from different providers, and seek professional advice to ensure they choose the most suitable coverage.