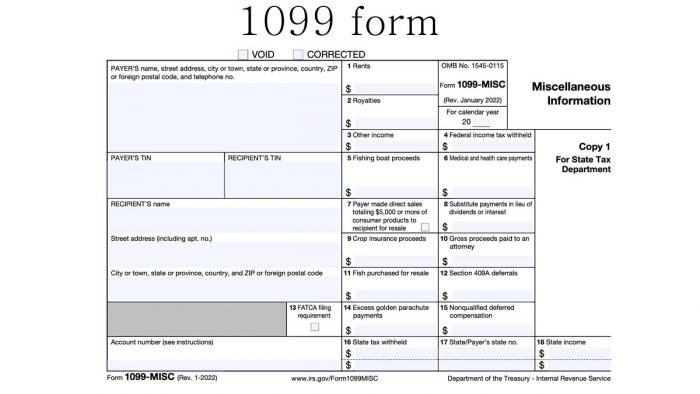

What is a 1099 form and what is it used for? A 1099 form is used to report non-employment income earned by someone who pays tax regularly. It reports the certain type of income that the taxpayer has earned through the entire year. Whether it is a cash dividend paid for owning a stock or the interest income earned from a bank account, 1099 can be issued. There are different types of 1099 forms since there are many ways to earn non-employment income. For example, as of the 2021 tax year, contractors and unemployed who earned $700 or more in non-employment income should receive the 1099 form.

However, a person who pays tax regularly might not like receiving tax documents, like 1099s and businesses may not like to issue them even less. 1099s are very important since they help to keep track of income that has not been recorded in a person’s wages or salary. The IRS matches all 1099s against other tax forms; if they do not match it can send out a CP2000 notice to taxpayers, saying they are owing more cash. If you want to know more about the 1099 form, follow this article to the end. That is because it will help you with everything you need to know about the 1099 form

Who needs to fill out the 1099 form?

1099 is an information filling form that needs to be filled out by individuals who earned more than $600 of work for businesses. All contractors and partnerships who did more than the above amount should receive a 1099 form. That means that the payer receives the form.

What are the types of 1099 forms?

Like it was stated earlier there are different types of the form. If you do not know about the different forms, do not panic. That is because below are the common types of the 1099 forms check them out.

- 1099-C

- 1099-B

- 1099-DIV

- 1099-MISC

- 1099-INT

- 1099-R

- I099-NEC

There are still so many more but the above are the most popular form that taxpayers receive most. This form is very important because it helps to keep the record which means every taxpayer needs it.

Where can I get a 1099 form?

The forms should be sent to you via mail or electronically from the organization issuing the funds such as the bank or creditors. However, if you do not receive one or think it was lost in the mail, you can reach out to the issuing organization. You can also contact the person you were expecting it from and ask if they sent it.

However, note that receiving the 1099 form does not mean you owe taxes on that money. The 1099 form is a record of income and that means that people can get the form for different reasons. Although it was not mentioned above the payer fills out the form and sends the copies to IRS. Get the 1099 form today and record your tax payment.